On December 8, Xometry announced it has acquired Thomas, a long time trusted resource for the manufacturing industry. The beginnings of these two companies could not be more different. According to an Information Today article, Mark Holst-Knudsen whose great-grandfather Harvey Mark Thomas founded Thomas Publishing in 1898, once joked that “Thomas Publishing Co. is the oldest internet company known to man.” The Thomas Register of American Manufacturers was a standard reference work in the form of a multivolume directory in large green books that helped buyers and sellers of industrial products find each other. It has been one of the best stories of old-school print publishers successfully transitioning content to online media. ThomasNet, the initial online directory, launched in 1995 as ThomasRegister.com. The last print edition was published in 2006 and since then “they have been lock, stock, and barrel, 100% an internet company.” Now in 2021, according to the press release, the Thomasnet.com platform has “more than 1.3 million registered users (including 93 percent of Fortune 1000 companies) and more than 500,000 commercial and industrial sellers, including 45,000 diversity certified sellers. Every year, more than 20 million sourcing sessions are initiated on Thomasnet.com, generating extensive first-party buyer intent data across multiple sectors.”

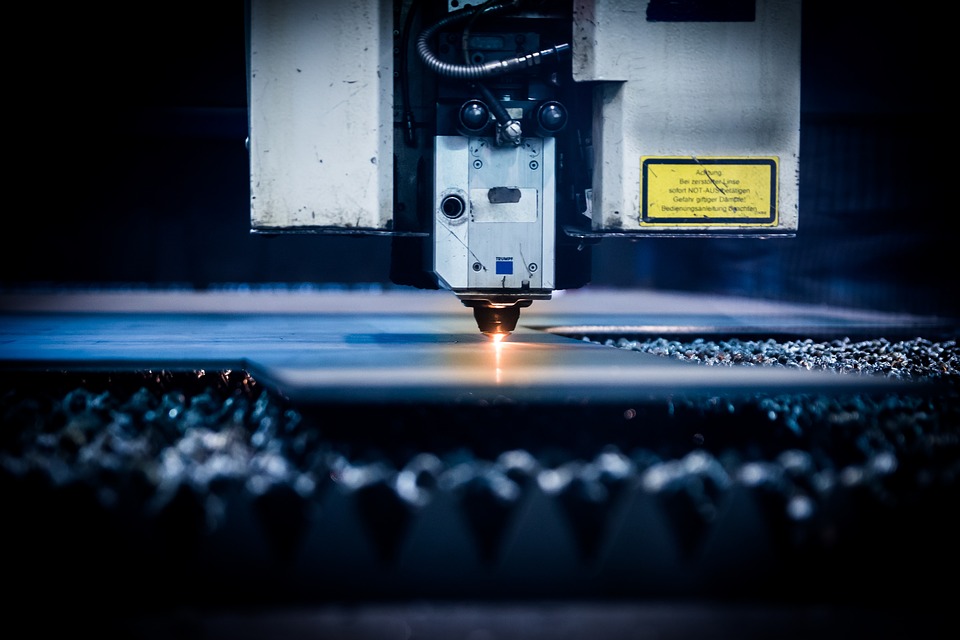

Xometry started out from the beginning as an AI-enabled marketplace for on-demand manufacturing. It uses proprietary technology to create a marketplace that enables buyers, ranging from self-funded startups to Fortune 100 companies, to efficiently source on-demand manufactured parts and assemblies. The company was founded in 2013 with this simple vision: “If there was a convenient web-based marketplace for books people to write and read, why shouldn’t there be a similar marketplace for products people to make and use?” Their goal is to digitize manufacturing, connect supply with demand, and provide a better sourcing solution to both buyers and sellers. They state that AI has helped them “create a liquid, scalable and global marketplace for the sourcing of on-demand parts,” which gives them “the opportunity to gain visibility into the supply and demand balance locally, regionally, and globally.” At the end of Q3 2021, Xometry had 26,187 active buyers, including nearly 30% of the Fortune 500.

According to Ronn Levine, SIIA’s editorial director, Thomas CEO Tony Uphoff and Xometry CEO Randy Altschuler initially met in 2017, where some talk about a partnership was bantered about. In July of this year, Altschuler reached out again to Uphoff stating, “We went public. Business is booming. Can we have a conversation?” Uphoff makes it a point to convey their model is “astoundingly complementary” to Xometry’s. Looking forward Thomas will remain its own brand, Thomasnet.com.

Both companies operate in highly competitive environments. Xometry, in a June 2021 SEC filing, states they compete “for buyers with a wide variety of manufacturers that include captive in-house product lines, on-demand parts manufacturers, and other marketplaces for manufacturing services” and their competitors include “vertically integrated service bureaus, the service bureau divisions of the additive OEM companies such as Stratasys and 3D Systems and independent machine shops and 3D printing service bureaus.” Thomasnet has been competing in an environment that not only includes longtime supplier discovery directory providers, such as Kompass and MFG, but is currently facing fiercer competition from the double whammy of B2B vertical marketplaces coming on the scene and the slew of ProcureTech startups, many focusing on sourcing, that are entering the space. Thomasnet has stayed competitive because it is a good, solid product that has always understood its users and the more boring, yet vital, aspect of presenting data that has been fully classified. Here’s hoping this acquisition turns out to be healthy and prosperous for both Thomas and Xometry.

Photo by Christopher Burns on Unsplash